As Ethereum continues to trail behind Bitcoin’s ongoing recovery in price, it seems the second-largest cryptocurrency by market cap is experiencing some positive developments in the background.

According to recent data from IntoTheBlock, large Ethereum holders, often called whales, have been actively accumulating Ethereum over the past month.

The Quiet Accumulation Of ETH From Whales

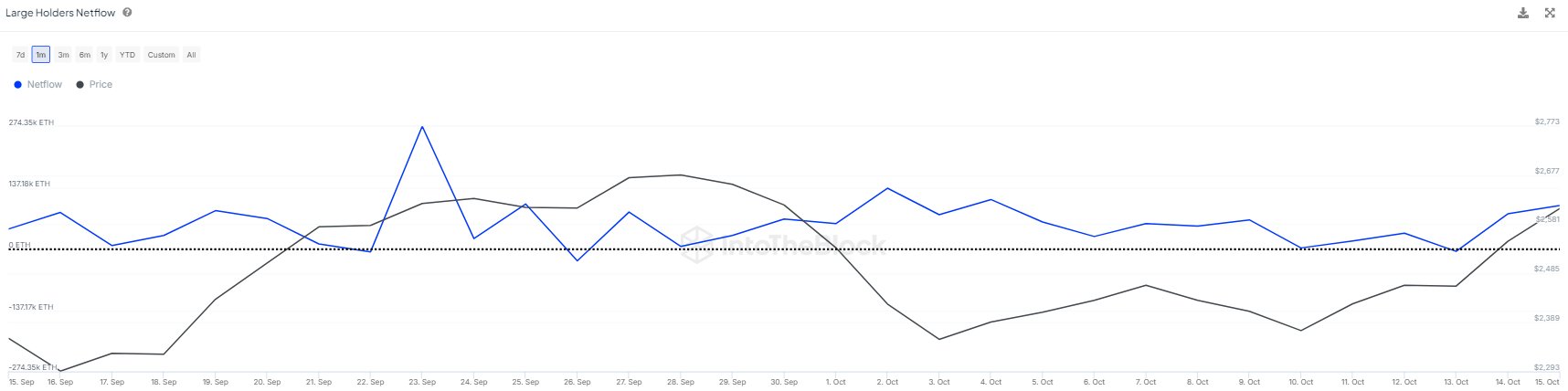

IntoTheBlock reported via its X account that Ethereum’s large holder net flow has increased notably over the past 30 days. Specifically, whale wallets, which hold more than 0.1% of Ethereum’s total supply, have recorded consistent net outflows, signaling “accumulation.”

According to the data, net outflows were recorded on just three days in the last month, meaning these large holders were predominantly adding to their positions.

In total, over 1.7 million ETH were accumulated during this period, with 175,000 ETH purchased in the last two days alone IntoTheBlock suggests that this strong accumulation behaviour from large holders typically indicates confidence in the asset’s long-term potential.

Over the past 30 days, ETH whale wallets have been actively accumulating, with net outflows recorded on only three days.

The large holder netflow indicator tracks when wallets holding more than 0.1% of the total supply are buying or selling.

In total, these wallets have… pic.twitter.com/om1UM9tArf — IntoTheBlock (@intotheblock) October 16, 2024

Ethereum Price Performance And Outlook

While large holders have been expressing confidence through their accumulation behavior, Ethereum’s price appears to be gradually reflecting this phenomenon. Over the past week, Ethereum has added around 5.9% to its value, reclaiming its ground above the $2,600 price mark.

In the last 24 hours, the asset has seen a slight increase of 1.3%, bringing its current trading price to $2,616, at the time of writing. Additionally, Ethereum’s daily trading volume has also increased significantly in the past week from below $14 billion last Wednesday to currently above $18 billion as of today.

Amid this price performance, crypto analyst CrediBULL shared his latest outlook on Ethereum. In a post on X, the analyst expressed concerns over Ethereum’s relative weakness against Bitcoin.

CrediBULL noted that while Ethereum showed some initial signs of strength, it failed to clear local highs during the most recent rally. This underperformance has led the analyst to believe that Ethereum may continue to struggle against Bitcoin in the short term.

Haven’t updated $ETH in a while. Has been showing considerable weakness against BTC recently (along with most alts).

While I had hoped for a short term window of outperformance before the final drop to sub 2k it doesn’t seem like we are going to get that at this time.

ETH… pic.twitter.com/CZJOoElHp3

— CrediBULL Crypto (@CredibleCrypto) October 15, 2024

Featured image created with DALL-E, Chart from TradingView

Source: NewsBTC.com